Ah, the age-old battle between the Boomers, Millennials, and Gen Z-ers. The clash of the generations as they navigate the treacherous waters of economic comparison. From avocado toast to TikTok trends, each group believes they have it rougher than the last. But who truly reigns supreme in the never-ending quest for financial stability? Let’s dive into the wild world of inter-generational economics and see who comes out on top!

Key Economic Indicators for Baby Boomers

So, you’re a baby boomer trying to navigate the crazy world of economics, huh? Don’t worry, I’ve got your back. Here are some key economic indicators that you should keep an eye on:

- Social Security Benefits: Make sure you’re up to date with how much you’re going to be getting from good ol’ Uncle Sam each month. You don’t want to end up living off ramen noodles because you didn’t plan ahead.

- Healthcare Costs: Let’s face it – as we get older, our bodies start falling apart. Keep track of rising healthcare costs so you don’t have to take out a second mortgage to pay for that knee replacement.

- Inflation Rates: Prices seem to be going up faster than your grandkids can text. Keep an eye on inflation rates so you can budget accordingly and still have enough money left over for those Sunday brunches.

Remember, knowledge is power – especially when it comes to your wallet. Stay informed, stay savvy, and most importantly, stay fabulous, baby boomer!

Income Disparities among Millennials

Forget avocado toast. The real issue that millennials are facing today is income disparities. While some of us are living it up in penthouse apartments, others are struggling to make ends meet while living with roommates in a cramped studio.

It’s like a cruel game of financial roulette, where some of us hit the jackpot while others are left scraping together pennies to pay our bills. But fear not, my fellow millennials, for there is hope on the horizon. With a little creativity and a lot of hard work, we can bridge the gap and level the playing field.

So, how can we start to tackle income disparities among our generation? Here are a few tips to get you started:

- Education: Invest in yourself by pursuing higher education or professional certifications to increase your earning potential.

- Networking: Build connections and leverage them to secure better job opportunities and salary negotiations.

- Side hustles: Explore alternative sources of income through freelance work, consulting, or starting your own business.

- Financial literacy: Educate yourself on budgeting, saving, and investing to make the most of your income and build long-term wealth.

Savings Habits of Generation X

Generation X may have the reputation of being the forgotten middle child between Baby Boomers and Millennials, but when it comes to saving money, they definitely know a thing or two. Here are some of the savings habits that set Generation X apart from the rest:

- Coupon Clippers: Generation X knows that the best way to stretch a dollar is by using coupons. They’re not afraid to whip out a stack of clipped coupons at the grocery store checkout and proudly announce how much they saved on their purchases.

- DIY Fanatics: Why pay someone else to do something when you can do it yourself? Generation X is all about tackling home improvements and repairs on their own to save money. Need a new bookshelf? No problem, they’ll just build it themselves.

- Thrifty Travelers: When it comes to vacations, Generation X knows how to travel on a budget. They’ll scour the internet for the best deals on flights and accommodations, and aren’t afraid to stay at budget-friendly hotels or even camp in the great outdoors.

While other generations may be quick to splash the cash on the latest gadgets and trends, Generation X is more focused on building a solid financial future through smart saving habits. So next time you see someone rocking a fanny pack and a “World’s Best Dad” t-shirt, just remember that they’re probably sitting on a hefty savings account.

Employment Challenges Facing Generation Z

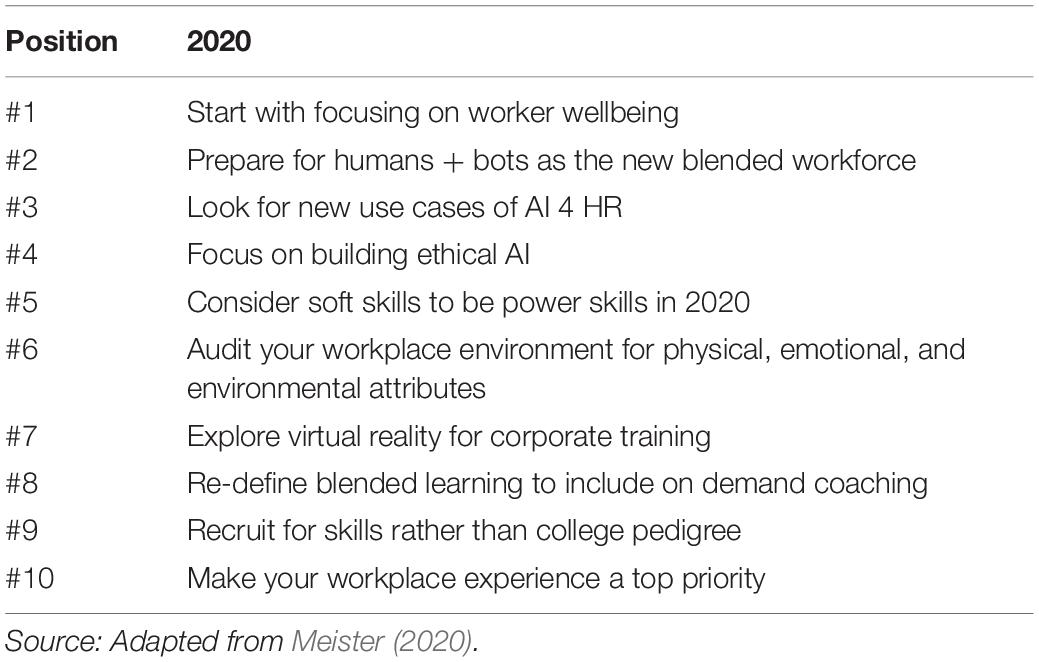

As members of Generation Z enter the workforce, they are facing some unique challenges that previous generations may not have encountered. From technological advancements to changing societal norms, it’s a whole new world out there for these young professionals.

One of the biggest challenges facing Generation Z in the job market is the rise of automation. With more and more tasks being taken over by robots and AI, it can be tough for young workers to find positions that haven’t been outsourced to machines. Plus, it’s not exactly encouraging to know that your job could be replaced by a toaster oven at any moment.

Another obstacle that Generation Z is up against is the pressure to constantly be connected. In today’s digital age, it’s expected that employees will be reachable at all times, whether through email, text, or Slack. Gone are the days of leaving work at the office – now, your boss can send you urgent emoji-filled messages at 2 am on a Saturday. How fun!

And let’s not forget about the dreaded “experience required” section of every job listing. It’s a catch-22 – you need experience to get a job, but you need a job to get experience. It’s enough to make any Gen Z-er want to throw their avocado toast out the window in frustration. But fear not, young grasshoppers – with your tech-savvy skills and killer TikTok game, you’ll conquer the job market in no time. Just don’t forget to put down your phone during interviews – eye contact is still a thing, apparently.

Investment Trends across Generations

Every generation has their own unique approach to investing. Let’s take a closer look at how different age groups are navigating the world of finance:

Gen Z

- Trading memes on Reddit instead of stocks

- Investing in cryptocurrency they don’t really understand

- Groupon for discounts on their first investment in index funds

Millennials

- Putting all their money into avocado toast futures

- Trying to buy property in a market that laughs at their savings account

- Investing in socially responsible companies because they care about the planet but also want to make money

Gen X

- Still trying to recover from the dot-com bubble burst

- Day trading with one eye on their retirement fund and the other on their rebellious teenage kids

- Considering investing in a timeshare in Aruba as a retirement plan

Impact of Education on Income Disparity

Ever wonder why your friend who dropped out of school is still stuck flipping burgers while you’re making bank? It’s all about that education, baby! Let’s break it down and see how hitting the books can help close that income gap faster than you can say “student loans”.

Level Up, Baby!

Education is like collecting power-ups in a video game. The more knowledge and skills you acquire, the stronger you become in the job market. You start off as a low-level intern, but with that fancy degree, you can quickly level up to a mid-level manager. Keep grinding, and maybe one day you’ll become the CEO, rolling in that sweet, sweet cash.

Knowledge is Power

With great education comes great earning potential. Those who invest in their education are more likely to land high-paying jobs that require specialized skills. It’s like having a cheat code in the game of life – you’ll be able to unlock those hidden levels of income that others can only dream of.

Break the Chains of Poverty

Education is the key to breaking free from the cycle of poverty. By getting a quality education, you open up doors to opportunities that can help you climb the income ladder. So next time someone tells you school isn’t important, remind them that education is the ultimate weapon against income inequality.

Social Security and Retirement Planning for Different Generations

As we navigate the murky waters of social security and retirement planning, it’s important to remember that each generation has its own unique challenges and opportunities. Let’s take a look at how different age groups can best prepare for their golden years:

- **Gen Z:** Ah, the young and fearless! While retirement might seem eons away, now is the perfect time to start setting aside money for the future. Instead of spending all your hard-earned cash on avocado toast, consider investing in a Roth IRA or employer-sponsored retirement plan. Your older self will thank you!

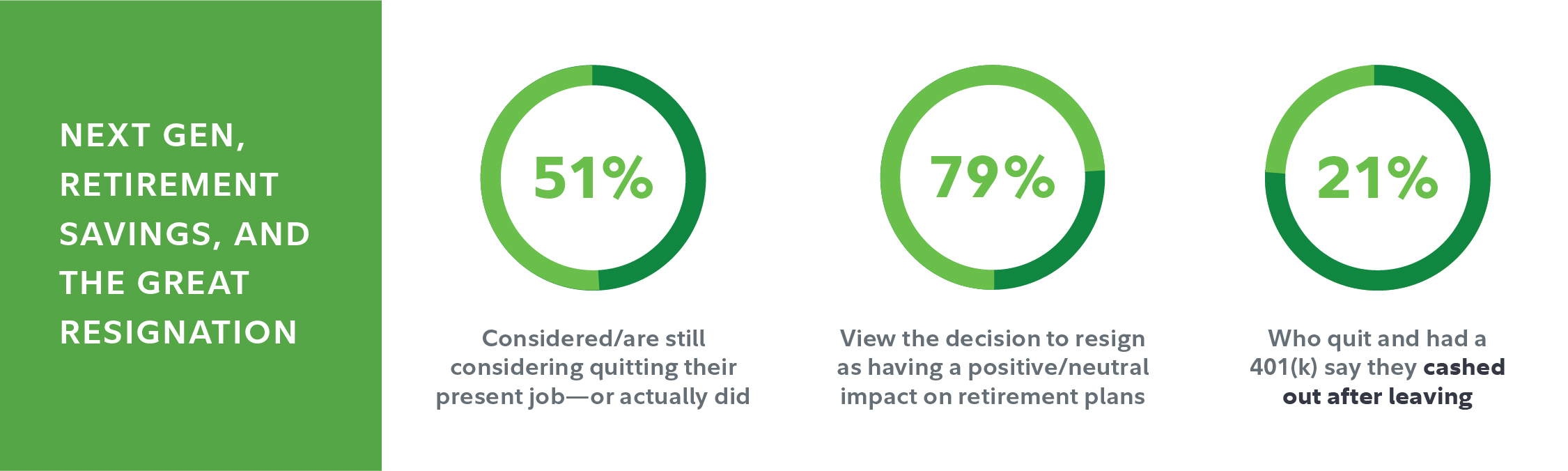

- **Millennials:** Ah, the eternal struggle of student loan debt! Millennials, it’s time to get serious about setting financial goals and sticking to a budget. Consider working with a financial planner to map out a retirement strategy that takes into account your debt repayment plan.

- **Gen X:** Ah, the sandwich generation! Balancing the needs of aging parents and college-bound kids can be a financial juggling act. Make sure you’re maximizing your retirement contributions and exploring long-term care insurance options to protect your nest egg.

- **Baby Boomers:** Ah, the wise elders! As retirement looms closer, it’s essential to reassess your investment strategy and make sure your portfolio is diversified. Consider delaying Social Security benefits to maximize your monthly payout and explore part-time work or downsizing to supplement your income.

FAQs

Q: How do the economic behaviors of Boomers, Millennials, and Gen Z differ?

A: Well, let me tell you, Boomers are all about saving those pennies for a rainy day, Millennials are all about avocado toast and fancy coffee shops, and Gen Z? Well, they’re over there making money off their TikTok fame.

Q: Do Boomers really have more financial stability compared to Millennials and Gen Z?

A: Oh, absolutely! Boomers had job security, pension plans, and affordable housing. Meanwhile, Millennials and Gen Z are over here drowning in student loan debt and high rent prices. Lucky ducks.

Q: How has technology impacted the financial habits of these different generations?

A: Ah, technology – the great equalizer. Boomers struggle to Venmo their friends, Millennials are day trading on Robinhood, and Gen Z is starting their own cryptocurrency. It’s a wild, wild world out there.

Q: Are there any trends in inter-generational wealth transfer that are worth noting?

A: Oh, absolutely! Boomers are passing down their summer homes and yacht club memberships, Millennials are inheriting debt and avocado toast recipes, and Gen Z is just excited to finally afford their own place without roommates.

Q: How can each generation learn from each other when it comes to financial planning and stability?

A: Boomers can teach Millennials and Gen Z about the power of long-term investments and saving for retirement. Meanwhile, Millennials and Gen Z can teach Boomers a thing or two about side hustles, investing in cryptocurrencies, and DIY budgeting apps. It’s a beautiful exchange of knowledge, really.

—

So who rules the economic roost?

Well, after crunching the numbers and delving into the wallets of Boomers, Millennials, and Gen Z, it seems like the answer is…no one really. Each generation has its own struggles and triumphs when it comes to money matters.

But hey, who needs a fat wallet when you’ve got a wealth of memes and avocado toast, am I right? Remember, it’s not about the size of your bank account, but the size of your heart…and the amount of student loan debt you’re drowning in.

So, whether you’re a Boomer, Millennial, or Gen Z-er, just remember to keep calm and carry on budgeting. After all, we’re all in this economic circus together. Cheers to financial stability…or at least financial survival!